State and federal financial aid programs can be an important part of a student’s financial aid package. Several of these programs are summarized below. To be eligible for Federal or State Aid, you must apply for the aid by completing the Free Application for Federal Student Aid (FAFSA). Visit StudentAid.gov/fafsa to learn more about the process. The FAFSA forms should be submitted electronically at studentaid.gov as soon as possible on or after October 1 for the following academic year to ensure eligibility for funds. Eureka College’s FAFSA code is 001678.

Contact Us:

Office Location: Admissions and Financial Aid building, Burgess Street

Regular office hours: Monday–Friday, 8am–5pm, evenings by appointment

Mailing Address:

Eureka College

Financial Aid

300 East College Ave

Eureka, IL 61530-1500

Telephone: 309-467-6310

Fax: 309-467-6897

Tim Marten, Director of Financial Aid, 309-467-6311

Will Brook, Financial Aid Specialist, 309-467-6310

Federal/State Financial Aid Loans and Programs

Illinois Monetary Award Program (MAP)

The MAP Grant program is provided by the State of Illinois to legal residents of Illinois based on financial need. Eligibility is based on information reported on the FAFSA. MAP Grants do not need to be repaid. Each year the State of Illinois has a deadline by which the FAFSA needs to be filed to be considered for this grant. We encourage you to file the FAFSA as soon as possible after October 1st using the IRS Data Retrieval Tool at https://studentaid.gov.

For more information regarding the State of Illinois Map Grant and/or other State of Illinois Programs visit https://www.isac.org/.

Federal Pell Grant

The Federal Pell Grant provides aid to students with very high need. The amount of the Federal Pell Grant is based on the Expected Family Contribution as calculated on the Free Application for Federal student Aid (FAFSA). The U.S. Department of Education sets an Expected Family Contribution (EFC) threshold. Then, when a student files a FASFA, it computes where the student lands within that threshold and determines if the student qualifies for the grant and for how much. The award amounts change each award year and depends on program funding. The amount receive will depend on financial need, cost of attendance, status as a full-time or part-time student, and plans to attend school for a full academic year or less. Please note the amount of Federal Pell Grant funds received over a student’s lifetime is limited by federal law to be no more than 12 semesters or equivalent (roughly six years). Since the amount of scheduled Pell Grant award is equal to 100%, the six year equivalent is 600%.

Supplemental Educational Opportunity Grant (SEOG)

The Federal SEOG is awarded to Pell Grant recipients with the highest financial need. The amount of SEOG is determined by Eureka College based on available funding levels. These funds are limited, and not all students who qualify can be assured that they will receive an SEOG grant. The Federal SEOG never has to be repaid.

Federal Direct Student Loan Options

Students must file the Free Application for Federal Student Aid (FAFSA) in order to be eligible to borrow through the Federal Direct Loan Program. Depending on the financial need will determine if the student qualifies for a Subsidized or Unsubsidized loan. These loans must be repaid with re-payment beginning 6 months after a student graduates, leaves school or falls below half-time. The interest rate and processing fees are determined annually. The federal government charges processing fees before disbursing the loan proceeds to Eureka College. To view interest rates and processing fees visit the Federal Student Aid website. Eureka College will request and receive the loan funds directly from the Federal government, half in each semester.

Federal Direct Subsidized Loan:

The Federal Direct Subsidized Loan is based on financial need. The federal government pays (or subsidizes) the interest that accrues on this loan during the time the student is consistently enrolled. No interest is charged and no payments are required on the principal during the student’s enrollment period.

Federal Direct Unsubsidized Loan:

The Federal Direct Unsubsidized Loan is not based on financial need. Unlike the subsidized loan, interest is charged while the student is enrolled. Therefore, the interest that accrues on the loan during the enrollment period is the student’s responsibility.

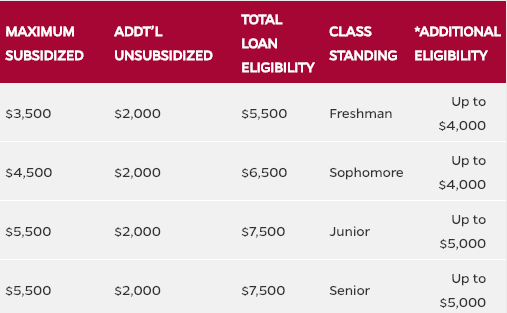

There are maximum borrowing limits for students that are determined based on the student’s class standing and earned credits. These are outlined below.

*Additional eligibility for Direct Loans exists for Independent Students or for Dependent students whose parent has been denied a Federal Parent (PLUS) Loan.

Steps to Complete Your Federal Direct Student Loan(s)

- IF you wish to accept the loan(s), you the student must accept your loans through your EC Self-Service Financial Aid Portal.

- New borrower: Complete a Direct Loan Master Promissory Note at studentaid.gov. You will click the log in button and login using your FSA ID and password. If you don’t already have an FSA ID, you will be prompted to create one. You will choose ‘Complete Master Promissory Note’ then ‘Subsidized/Unsubsidized’. Continue entering your information until the Promissory Note is signed and you receive an on-screen confirmation of completion.

- New borrower: Complete Entrance Counseling at studentaid.gov. You will sign in (or continue on from signing your Master Promissory Note) and click on ‘Complete Entrance Counseling’. Continue reading the content and answering the questions until you see “Congratulations, you are finished”.

Electronic-Signing the MPN and completing entrance loan counseling are federal requirements for all student loan borrowers and must be completed prior to the loan being disbursed. Once you have finished the steps above, the Eureka College’s Office of Financial Aid will be notified and will proceed with processing your loan electronically with the Federal Government. All disclosures and legal documents for the loan will be provided directly from the Department of Education, Direct Loans.

Federal Direct Parent Plus Loan

The Federal PLUS Loan is available to creditworthy parents and is not based on financial need. Parents of students who need additional help in financing their student’s education and who have filed the Free Application of Federal Student Aid (FAFSA), have the option to borrow through the Federal Parent Plus Loan Program. The interest rate and processing fees are determined annually. The federal government charges processing fees before disbursing the loan proceeds to Eureka College. To view interest rates and processing fees visit https://studentaid.gov/. Eureka College will request and receive the loan funds directly from the Federal government, half in each semester. Repayment begins immediately after the last disbursement of the loan is made for the school year. This means that the parent must begin repayment while the student is still in school, although deferment is an option.

Steps to Complete Your Federal Direct Parent PLUS Loan

First time Parent Plus loan borrowers must complete the following two steps. Continued Parent Plus loan borrowers only need to complete step one.

- Complete a PLUS loan application at StudentAid.gov by clicking the Log in button. Log in using your (the parent) recently created FSA ID and password. If you do not have a FSA ID and password, you will be prompted to create one. After you have successfully signed in, click on ‘Request a PLUS Loan’. The loan type will be the Parent PLUS. Fill in all the requested parent data and submit according to the instructions provided. You will need to specify the dollar amount or choose the maximum amount you wish to borrow for the entire year. The credit decision is given immediately on the last page of the application. If your credit is denied, it is NOT necessary to complete step 2.

- ‘Complete a Master Promissory Note’ for a Parent PLUS loan while you are already signed in at StudentAid.gov. Fill in all the requested parent data and submit. The Financial Aid Office will be notified electronically, normally within 48 hours, when it is complete.

Once a parent has completed the steps, the Financial Aid Office will process the loan electronically with the Federal Government.

Additional eligibility for Direct Loans exists for Independent Students or for Dependent students whose parent has been denied a Federal Parent (PLUS) Loan. View Federal Direct Student Loan Options section for additional eligibility amounts.

Federal Work Study

This federally funded program is based on financial need. To receive this award, a qualifying student must obtain a campus job. Federal Work Study dollars will fund the student’s paycheck and therefore will not be reflected on the EC student account. It will be the responsibility of the student to determine how to use these funds wisely. Federal Work Study is not a guarantee of job placement. Federal Work Study awards are not required for students to obtain on campus jobs.